Understanding why National Tax Advisory Services is calling you

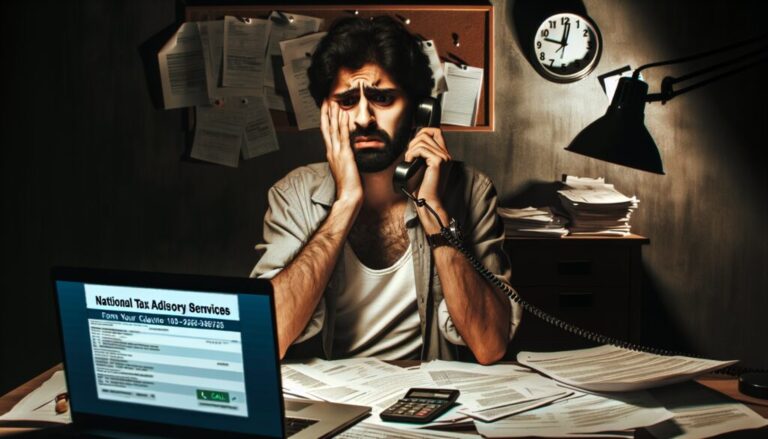

Receiving a call out of the blue from a tax advisory service can be a disconcerting experience, especially with the rising number of phone scams. When an organization such as National Tax Advisory Services contacts you, it's crucial to determine whether the communication is legitimate and if their services are required for your financial situation.

In this article, we will delve into what National Tax Advisory Services LLC is, explore why they might be reaching out to you, examine common complaints, identify red flags, and provide steps to verify the authenticity of their calls. This information aims to equip you with the knowledge to avoid potential scams and make informed decisions regarding your tax-related needs.

- What is National Tax Advisory Services LLC?

- Why is National Tax Advisory Services Calling Me?

- Common Complaints About National Tax Advisory Services

- Red Flags and Warning Signs

- How to Verify the Authenticity of Calls

- Steps to Take if You Suspect a Scam

- Questions Related to National Tax Advisory Services

What is National Tax Advisory Services LLC?

National Tax Advisory Services (NTAS) is a company that purports to offer tax debt relief services and tax preparation help. NTAS claims to provide personalized assistance to individuals struggling with IRS tax debt by potentially reducing the amounts owed through various programs and negotiations.

The company operates remotely, allowing them to reach a wide range of clients. However, remote operations can also raise questions about the company's legitimacy, as it may be harder to verify their credentials and physical presence.

While there are legitimate companies offering tax advisory services, it's important for consumers to conduct thorough research and ensure they're dealing with a credible entity before engaging in any services or sharing personal information.

Why is National Tax Advisory Services Calling Me?

If you've received a call from National Tax Advisory Services, it may be an attempt to offer you their services, such as IRS tax debt relief or tax preparation. These unsolicited calls are typically part of their marketing strategy to acquire new clients.

However, be cautious as the company may claim to have a special tax program that can significantly reduce or even eradicate your tax debt. This is a common tactic used by fraudulent services to lure individuals into a scam. It's wise to approach such offers with skepticism until their legitimacy can be confirmed.

Another reason for their call could be a follow-up to a previous inquiry you made regarding tax services. Ensure the call is indeed coming from NTAS by asking for verifiable contact information and reaching out to them directly through official channels.

Common Complaints About National Tax Advisory Services

NTAS has been the subject of numerous complaints, with individuals reporting unsolicited calls from tax services. Many of these complaints point to a lack of professionalism and transparency from the company's representatives.

- Aggressive marketing tactics, including persistent calling, even when individuals have indicated they are not interested.

- Claims of endorsement by the IRS or other governmental agencies, which is a false and misleading statement.

- Offering 'too good to be true' tax debt solutions that are generally not feasible.

The high volume of complaints and negative feedback is a red flag for consumers. It's vital to take such reviews into account when considering whether to engage with NTAS or any tax advisory service.

Red Flags and Warning Signs

There are several red flags for National Tax Advisory Services scam operations to be aware of:

- Urgency in their offers, pressuring you to act quickly without giving you time to think or consult a professional.

- Lack of personalization in their communications, indicating a possible mass scamming attempt.

- Use of robo-calls, which is not a common practice among legitimate tax advisory services.

- Attempts to gather personal or financial information over the phone.

Beware of these warning signs and always opt for due diligence before responding to any unsolicited calls related to tax services.

How to Verify the Authenticity of Calls

To verify tax service calls, start by requesting the caller's full name, company, and contact information. Cross-reference this information with your own research to ensure they are indeed connected to NTAS.

Check official channels, such as the company's website or direct phone lines, and compare the contact information provided by the caller. A legitimate company will be transparent about their contact details.

Additionally, look up reviews and complaints on reputable platforms like the Better Business Bureau (BBB). If discrepancies appear in the contact information or if the caller's claims seem dubious, it's likely a scam.

Steps to Take if You Suspect a Scam

If you suspect that you are dealing with a scam, the first step is to cease all communication with the caller. Do not provide any personal or financial information.

Report the incident to consumer protection agencies, such as the Federal Trade Commission (FTC) or the BBB. This not only helps you but also aids in preventing others from falling victim to the same scheme.

Implement protective measures such as monitoring your credit reports and considering a call-blocking service to prevent future unsolicited calls.

An informative video on the topic of tax scams highlights the importance of recognizing and avoiding these fraudulent activities:

What is a Tax Advisory?

A tax advisory is a service that provides expert advice on tax-related matters. Legitimate advisors help individuals and businesses navigate complex tax laws to ensure compliance and optimize tax strategies.

A credible tax advisor will hold relevant qualifications and adhere to professional standards. They offer personalized advice and maintain transparency in their dealings with clients.

Does the IRS Ever Call You?

The IRS typically does not initiate contact with taxpayers by phone to request personal or financial information. If you receive such a call, it's likely a scam. The IRS usually contacts individuals through mail. Always verify any unexpected communication claiming to be from the IRS.

It's essential to be vigilant when receiving calls from any tax advisory service, including NTAS. By staying informed, asking the right questions, and verifying information, you can protect yourself from potential scams and make sound decisions regarding your tax affairs.